My Budget Book is a comprehensive financial management application designed to help users efficiently manage their personal finances. With its user-friendly interface and powerful features, the app has gained popularity as a valuable tool for budgeting, tracking expenses, and achieving financial goals.

Key Features

Expense Tracking:

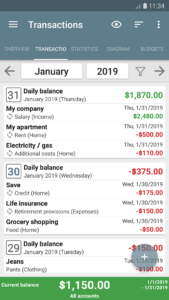

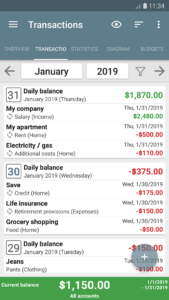

My Budget Book enables users to record and categorize their daily expenses. It allows you to input transactions manually, making it easy to track spending across various categories such as groceries, entertainment, utilities, and more.

Budget Planning:

The app aids in creating budgets for different time periods—monthly, weekly, or custom-defined. Users can set spending limits for each expense category and receive notifications when they approach their limits, promoting better financial discipline.

Income Management:

Users can log their income sources, helping them maintain a comprehensive overview of their financial inflows. This feature is particularly useful for tracking salary, freelance earnings, investments, and other income streams.

Visual Analytics:

My Budget Book provides graphical representations of spending patterns and income trends. Interactive charts and graphs allow users to identify where their money is going and make informed decisions to adjust their financial habits accordingly.

Multiple Accounts:

The app supports managing multiple accounts, making it suitable for individuals, couples, or even small businesses. Each account can have its own set of budgets and expenses, ensuring flexibility and customization.

Bill Reminders:

Users can set up bill reminders to avoid missing payment deadlines. This feature assists in preventing late fees and maintaining a good credit history.

Data Backup and Sync:

My Budget Book offers options for data backup and synchronization across devices. This ensures that financial data remains secure and accessible, even if a device is lost or replaced.

Reports and Exporting:

The app generates detailed financial reports, facilitating a deeper understanding of spending habits over time. Users can also export data in various formats, making it convenient for tax preparation and financial planning.

User Benefits

Financial Awareness:

My Budget Book promotes heightened awareness of spending habits, helping users make more informed choices and reduce unnecessary expenses.

Goal Achievement:

By setting budgets and tracking progress, users can work towards their financial goals, whether it's saving for a vacation, paying off debts, or building an emergency fund.

Simplicity:

The app's intuitive interface and straightforward data entry process make it accessible for users of varying levels of technical expertise.

Privacy and Security:

My Budget Book prioritizes user data security, ensuring that sensitive financial information is protected.

Conclusion

My Budget Book stands out as an essential tool for individuals aiming to take control of their finances. With its array of features for expense tracking, budget planning, and financial analysis, the app empowers users to make informed decisions that contribute to their financial well-being.

Screenshots

[appbox googleplay com.onetwoapps.mh]

| Name | My Budget Book v9.2.1 [Paid] |

|---|---|

| Publisher | OneTwoApps |

| Genre | Finance |

| Version | 9.5 |

| Update | 09/05/2024 |

| MOD | Paid / Patched |

| Get it On | Play Store |

- Languages: Full Multi Languages;

- CPUs: armeabi-v7a, arm64-v8a, x86, x86_64;

- Screen DPIs: 160dpi, 240dpi, 320dpi, 480dpi, 640dpi;

- Untouched apk with Original Hash Signature, no [Mod] or changes was applied;

- Certificate MD5 digest: 6d46020c4f8e811c1ec1b73b6c9dbb81

My Budget Book is a comprehensive financial management application designed to help users efficiently manage their personal finances. With its user-friendly interface and powerful features, the app has gained popularity as a valuable tool for budgeting, tracking expenses, and achieving financial goals.

Key Features

Expense Tracking:

My Budget Book enables users to record and categorize their daily expenses. It allows you to input transactions manually, making it easy to track spending across various categories such as groceries, entertainment, utilities, and more.

Budget Planning:

The app aids in creating budgets for different time periods—monthly, weekly, or custom-defined. Users can set spending limits for each expense category and receive notifications when they approach their limits, promoting better financial discipline.

Income Management:

Users can log their income sources, helping them maintain a comprehensive overview of their financial inflows. This feature is particularly useful for tracking salary, freelance earnings, investments, and other income streams.

Visual Analytics:

My Budget Book provides graphical representations of spending patterns and income trends. Interactive charts and graphs allow users to identify where their money is going and make informed decisions to adjust their financial habits accordingly.

Multiple Accounts:

The app supports managing multiple accounts, making it suitable for individuals, couples, or even small businesses. Each account can have its own set of budgets and expenses, ensuring flexibility and customization.

Bill Reminders:

Users can set up bill reminders to avoid missing payment deadlines. This feature assists in preventing late fees and maintaining a good credit history.

Data Backup and Sync:

My Budget Book offers options for data backup and synchronization across devices. This ensures that financial data remains secure and accessible, even if a device is lost or replaced.

Reports and Exporting:

The app generates detailed financial reports, facilitating a deeper understanding of spending habits over time. Users can also export data in various formats, making it convenient for tax preparation and financial planning.

User Benefits

Financial Awareness:

My Budget Book promotes heightened awareness of spending habits, helping users make more informed choices and reduce unnecessary expenses.

Goal Achievement:

By setting budgets and tracking progress, users can work towards their financial goals, whether it’s saving for a vacation, paying off debts, or building an emergency fund.

Simplicity:

The app’s intuitive interface and straightforward data entry process make it accessible for users of varying levels of technical expertise.

Privacy and Security:

My Budget Book prioritizes user data security, ensuring that sensitive financial information is protected.

Conclusion

My Budget Book stands out as an essential tool for individuals aiming to take control of their finances. With its array of features for expense tracking, budget planning, and financial analysis, the app empowers users to make informed decisions that contribute to their financial well-being.

Screenshots